Profitability and optimized performance pressure from top management are driving CFOs and Finance executives to develop and maintain effective financial planning and analysis skills. It also means going beyond the numbers by bringing the voice of the customer into the spectrum. To deliver exemplary financial planning and analysis results, you must have clear understanding ofContinue reading “Planning, Budgeting and Forecasting”

Category Archives: General Accounting

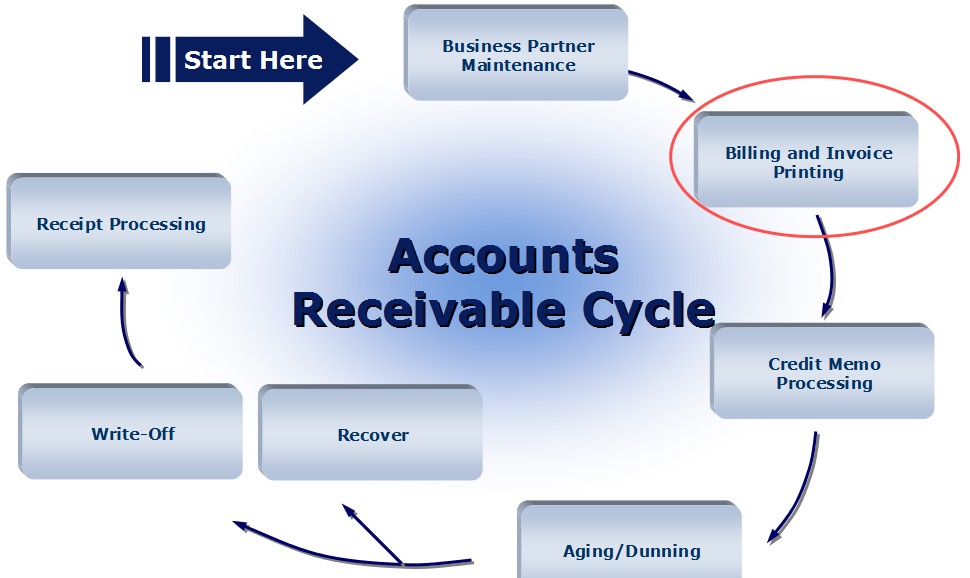

E.O.W (End of the week) Notable Tip: Client-centric Accounts Receivable

Happy Friday! I hope you’ve had a great week. Today’s E.O.W is about encouraging your accounting team to embody a more client-centric approach to accounts receivable by asking smart questions that glean insights into what clients value most and what their priorities are. To truly understand that customer everyone must be part of the customerContinue reading “E.O.W (End of the week) Notable Tip: Client-centric Accounts Receivable”

Days Sales Outstanding: Get Paid Faster tips

You’ve made a sale! That’s great but the customer hasn’t paid and the invoice is now 90 days past due. This scenario is common amongst many businesses. Many businesses resort to offering extended payment terms but this is a bad idea because it affects their cashflow. What you really want is client satisfaction because whenContinue reading “Days Sales Outstanding: Get Paid Faster tips”

Lean Wednesday Tip: Tax savvy family-owned businesses

“Family businesses allow tax savings through income splitting between parents, children or other relatives.”

E.O.W(End of the Week) Notable Tip: Return on Assets

Happy Friday! I hope you’ve had a great week. Today, I would like to discuss return on assets. Effective companies utilize their assets wisely by ensuring for example that low margins are supported by an equally low asset density coupled with the ability to remove waste and inefficiencies from processes. Continuous investment in assets andContinue reading “E.O.W(End of the Week) Notable Tip: Return on Assets”

E.O.W (End of the Week) Notable Tip: Numbers Vs People

Happy Friday! I hope you’ve had a great week! Read below for the EOW for today, Friday, October 6, 2017. “When it comes to safeguarding the bottom-line, hitting the numbers is the only focus. This narrow thought process causes leaders to lose sight of what truly drives those numbers and that is their employees andContinue reading “E.O.W (End of the Week) Notable Tip: Numbers Vs People”

Lean Wednesday Tip: Tax deductible Holiday Expenses

“Employee parties/outings, public entertainment and charity events are 100% deductible.”

Taxes: Depreciation Categories

When buying assets it is important to know the best way to purchase and depreciate to take advantage of tax loopholes. Capital expenses usually include the following assets: buildings, cell phones, computers and software, copyrights and patents, equipment, improvements to business property, inventory, office furnishings and decorations, small tools and equipment, vehicles and window coverings.Continue reading “Taxes: Depreciation Categories”

Lean Wednesday Tip: Maxing out Asset Depreciation Deductions

“If you max out asset depreciation deductions and have written it off 100%, it is best to donate it to reduce income taxes.”

Lean Wednesday Tip: Tax considerations for C Corporation Dividend Payouts

“Avoid double taxation of a C Corporation’s dividend payout by structuring payments to shareholders as consulting fees. Shareholders must actually offer advice for the payments to be considered valid tax deductible transactions.”