Abstract. In this paper on logistics firms’ revenue model, I will present comprehensive revenue strategies that will fortify business continuity during uncertain economic conditions like inflation and recession periods. With the current state of tariffs as of March 25, 2025, understanding how this will impact consumer behavior is key for optimizing revenue strategies and value propositions. The focus is on understanding the Voice of the Customer and industry trends to realize alternative revenue opportunities that will protect against economic volatility. Using RStudio and dummy data to develop advanced analytics and statistical visualizations to present data-driven insights supporting five key revenue strategies.

Executive Summary

During an era of economic volatility, logistics firms’ vulnerabilities to recession and inflation are heightened, which can cause significant erosion to revenue and diminish profit margins. In this paper, I will propose a multifaceted revenue strategy to build resilience and achieve revenue targets through proactive diversification:

- Analytics-as-a-Service: Monetize logistics data via dashboards and predictive insights.

- Tiered Pricing & Customer Segmentation: Roll-out tiered plans (Basic, Standard, Premium) aligned with customer value and willingness to pay.

- Loyalty & Promotions: Implement rewards and bundled services to reduce churn and strengthen customer lifetime value.

- Strategic Partnerships: Develop partnerships with tech providers, carriers, and fuel suppliers to unlock innovation and cost efficiencies.

- Sustainability & Continuous Improvement: Focus on high-ROI green initiatives, optimizing operations and meeting growing demand for ESG accountability.

Through a comprehensive needs analysis, financial modeling, and data-driven tools including R-powered clustering, pricing simulations, and ROI matrices, this strategy equips logistics firms not only to survive economic downturns but also to seize growth opportunities. The findings presented in this paper will highlight that bundling analytics and loyalty programs, combined with strategic partnerships will yield the highest returns in both short- and long-term scenarios.

Industry & Economic Context

Currently within the logistics industry there is a sustained freight recession, driven by weakened global demand, oversupply of capacity, and depressed freight rates. Extensiv, “Transformative Logistics Strategies: Overcoming the Freight Recession” (2024), “The magnitude of the crisis facing the logistics industry cannot be overstated. With over 80,000 trucking companies and 8,000 brokers closing their operations, the sector is experiencing a contraction that mirrors the broader economic downturns of the past, yet with distinct characteristics unique to today’s global supply chain complexities. Notable examples such as the bankruptcy of Yellow Freight and the financial troubles of previously high-valued companies like Convoy highlight the vulnerability of the logistics sector to the current economic headwinds.”

Rising fuel prices, maintenance costs, and wage pressures have squeezed margins for logistics operators. Therein, rising layoffs in the transportation, warehousing, and manufacturing sectors are signaling a softening of labor markets, with unemployment edging toward 4.3% in May 2025. The current Tariff War and protectionist policies have disrupted global trade flows, increased costs, and induced inventory overstocking. Shippers are also facing higher tender rejections and spot rates, reflecting tightening conditions, yet structural uncertainties persist.

Surging need for fraud prevention and better data-driven insights has motivated firms to increase the adoption of predictive analytics, AI, automation, and digital freight platforms. Xeneta, “The Biggest Global Supply Chain Risks of 2025” (2025), “Digital twin technology has also emerged as a key driver of supply chain growth. According to McKinsey, the global market for digital twins will grow about 30 to 40 percent annually in the next few years, reaching $125 billion to $150 billion by 2032. Digital twins create a digital model of a physical product, system, or process, including its functionality, features, and behavior. In supply chains, they’re helping organizations model strategic changes made in response to emerging risks. By enabling teams to validate the impact of those changes, digital twins can help organizations invest in the right areas and make the decisions that deliver the best impact for their business, customers, and global supply chain operations.”

Consumer and stakeholder behavior shifts towards sustainability coupled with regulatory mandates are pressuring logistics providers to reduce emissions and transition to cleaner technologies (e.g., electrified fleets), especially in regions like California. ESG initiatives also offer cost-saving potential through route optimization and reduced fuel dependency.

Real World Case Studies

Since the depression era companies have found creative ways to strengthen their resilience during economic volatility. Logistic businesses are no stranger to creative strategies for ensuring business continuity during economic downturns.

Firstly, let’s consider FedEx. During the 2001 Recession, FedEx successfully shifted focus to capitalize on the e-commerce surge. To combat financial uncertainty, it focused on the following:

- Accelerated tech upgrades—real-time tracking, automated sorting centers

- Developed partnerships with key retailers like Amazon and improved delivery flexibility

These initiatives allowed FedEx to sustain revenue growth, improve customer loyalty, and increase operational efficiency. Thus, demonstrating how pivoting to emerging market demands, and tech-led innovation can turn downturns into opportunities.

Secondly, we will consider UPS. Also, during a recession period in 2008, UPS strengthened its performance by embracing the following initiatives:

- “Implementation of its ORION (On-Road Integrated Optimization and Navigation) system, which used advanced algorithms to optimize delivery routes.”

- Operations Management: renegotiated contracts, consolidated shipments, minimized energy waste

These strategies allowed for multi-million-dollar savings that preserved margins through revenue dips and builds a preliminary case for the need for logistic firms to build strong alternative income sources as will be expanded on in the following needs analysis.

Needs Analysis

Background: The logistics industry’s sensitivity to macroeconomic conditions like recessions and inflation make it prone to financial instability. During these periods, customer demand may decline, fluctuations in cost (e.g., fuel, maintenance, labor), and reduced profit margins. Maintaining financial stability and growth during such periods will require developing alternative sources of income and strengthening value proposition.

Problem Statement: Logistic firm’s current revenue strategy is not resilient to economic downturns. It is imperative that proactive initiatives to safeguard income, attract and retain customers, and improve operational efficiency be implemented.

Objectives:

- Develop multiple revenue streams resilient to economic downturns.

- Increase customer retention and lifetime value.

- Identify unique value propositions.

- Optimize pricing strategies (e.g. 3-Level Pricing plus customer segmentation).

- Utilize the Voice of the Customer through all strategic initiatives to ensure a positive impact on ROI and customer satisfaction.

Identified Needs:

- Monetization of Data & Analytics (Revenue Strategy 1)

- Need: Constant ad-hoc report requests from customers who want insights into logistics metrics (e.g. delivery times, route optimization, periodical spending)

- Opportunity: Develop a paid analytics product or dashboard.

- Impact: Serves as a new revenue source, deepens customer relationships and shows the firm as a strategic partner.

- TieredPricing & Customer Segmentation (Revenue Strategy 2)

- Need: Customers have different needs, resources, and a one-fits-all pricing is not effective.

- Opportunity: Introduce three-tier pricing (e.g., Basic, Standard, Premium) aligned to customer value and volume.

- Impact: Optimizes price competitiveness, increases customers acquisition, and maximizes revenue from high-value customers.

- Loyalty Programs and Promotions (Revenue Strategy 3)

- Need: Economic downturns lead to customer price sensitivity and churn.

- Opportunity: Implement loyalty points, volume discounts, or bundled services to retain clients.

- Impact: Improves customer retention, increases repeat business, and strengthens brand loyalty.

- Strategic Partnerships (Revenue Strategy 4)

- Need: During inflation periods, higher costs require creative cost control and expanded value offerings.

- Opportunity: Build strategic partnerships with technology providers, fuel companies, or regional carriers to share costs and innovative services.

- Impact: Enables operational efficiency, cost reduction, and differentiation through expanded capabilities.

- Sustainability & Continuous Improvement Initiatives (Revenue Strategy 5)

- Need: Environmental responsibility has become critically important to customers and a growing number of organizations.

- Opportunity: Launch sustainability initiatives that reduce waste, fuel usage, or optimize routes-that are based on a benefit-cost analysis for highest ROI.

- Impact: Expands customer base by attracting sustainability-focused clients, reduces operational costs, and positions the firm as an authoritative and forward-thinking leader.

Stakeholders

- Top Management (strategic decision-making, budget allocation)

- Sales & Marketing Teams (customer engagement, tiered offerings)

- Operations (Efficiency and Sustainability Initiatives agents)

- Finance (ROI analysis, pricing strategy)

- IT/Analytics (Analytics Products/Dashboard development)

Conclusion

A diverse revenue strategy is key for a logistic firm to weather economic downturns and uncertainties. By implementing a revenue strategy centered on customer value, efficiency, and innovation coupled with the five identified strategies which address specific needs and when implemented, provide a comprehensive approach to resilience and growth.

Detailed Revenue Strategy Roadmap

In effort to protect its business model from recession and inflation, the logistics firm will implement five interconnected revenue strategies. Each strategy is designed to improve financial resilience, drive customer value, and enhance operational adaptability. Provided below is the roadmap detailing the objectives, execution plan, required resources, KPIs, and ROI potential of each strategy.

Revenue Strategy 1: Analytics‑as‑a‑Service

Objective: Offer advanced analytics dashboards and insights to clients by monetizing internal logistics data, thus yielding optimized visibility and decision-making across their supply chains.

Execution Plan:

- Create client-facing dashboards (e.g., delivery time analysis, route optimization, carbon footprint tracking).

- Bundle analytics with mid-tier and premium service packages.

- Recommend custom analytics solutions for enterprise clients.

Tools & Resources:

- Business intelligence platforms (e.g., Power BI, Tableau)

- Data engineers and data scientists

- API integration with client systems

KPIs:

- Percentage of customers subscribing to analytics add-ons

- Net new revenue from analytics services

- Customer Satisfaction score for analytics services

Expected ROI: High, as the new revenue stream utilizes minimal variable costs once infrastructure is built. Enhance customer retention and upsell opportunities.

Revenue Strategy 2: Tiered Pricing & Customer Segmentation

Objective: Roll-out a three-level pricing structure aligned to customer value, service intensity, and willingness to pay.

Execution Plan:

- Clearly defined and value-added tiers: Basic (low-touch), Standard (balanced), Premium (white glove, analytics included).

- Segment customers using historical spend, volume, and industry (via R clustering analysis).

- Utilize random customer base sample (revenue, monthly load count) for Pilot pricing tiers; refine based on feedback.

Tools & Resources:

- CRM and billing systems

- Sales and marketing alignment

- Customer segmentation model (built in R)

KPIs:

- Revenue per user (ARPU) by tier

- Tier conversation rate (Basic – Standard – Premium)

- Customer churn per tier

Expected ROI: Moderate to High. This strategy secures more value from high-end clients while remaining competitive for price-sensitive ones while enhancing predictability of revenue.

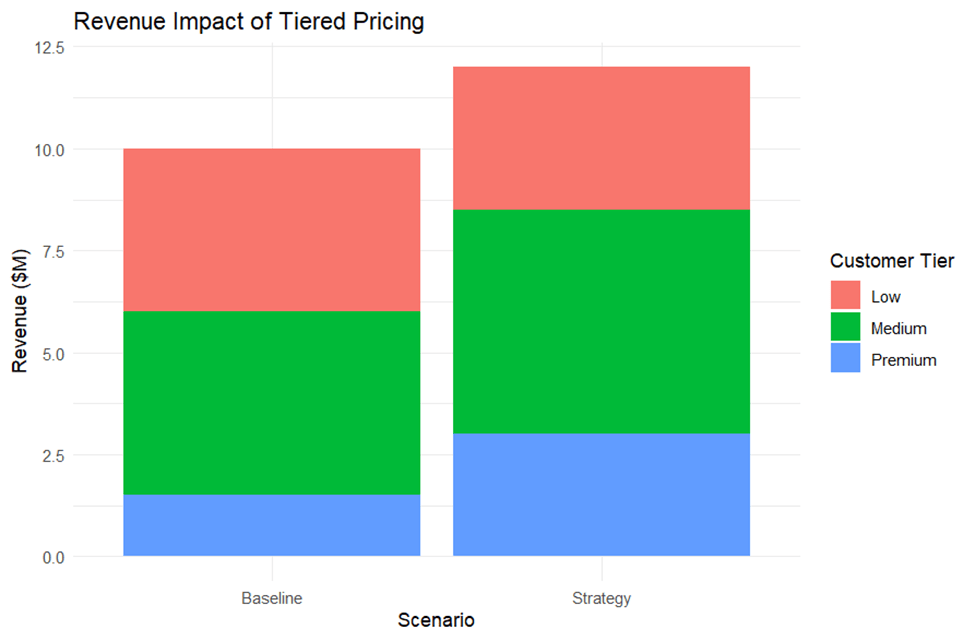

Example Dummy Data Scenario Analysis

Utilizing dummy data and R, I created baseline data and strategy specific (tier pricing) visual below that demonstrates impact on revenue based on the implementation of tier pricing.

Revenue Strategy 3: Loyalty Programs & Promotions

Objective: Boost customer retention, reduce churn, and gain repeat business through targeted rewards, volume discounts, and seasonal promotions.

Execution Plan:

- Establish a points-based loyalty program (e.g., discounts after a certain number of shipments).

- Proposition tier-specific loyalty perks (e.g., free analytics access for Premium users).

- Roll out promotional offers during peak off-season or to recover lost clients.

Tools & Resources:

- CRM and marketing automation

- Customer feedback systems

- Predictive Churn modeling

KPIs:

- Customer Retention Rate

- Repeat purchase frequency

- Program participation rate

Expected ROI: Moderate. Loyalty programs have costs but when executed properly they significantly reduce acquisition costs and increase customer lifetime value (CLV).

Revenue Strategy 4: Strategic Partnerships

Objective: Develop partnerships that reduce operating costs, expand service capabilities, or add complementary value to customers.

Execution Plan

- Build partnerships with fuel providers for bulk rate savings

- Collaborate with regional carriers to extend service reach at lower marginal cost.

- Offer value-added services (e.g., insurance, packaging) via third-party partners.

Tools & Resources:

- Business development team

- Legal/contracts team

- Shared tech infrastructure or APIs

KPIs:

- Partnership benefit-cost savings

- Revenue from joint offerings

- % of customers utilizing partner services

Expected ROI: High. Internal costs are reduced and newly bundled services offered to clients. Broader differentiation created and customer stickiness.

Example Dummy Data: Strategic Partnerships Scenario Analysis

Revenue Strategy 5: Sustainability & Continuous Improvement Initiatives

Objective: Use a benefit-cost framework to identify and implement high impact and operational efficiency initiatives.

Execution Plan:

- Conduct a company-wide audit of resource waste, emissions, and process inefficiencies.

- Utilize R to plot ROI vs. customer impact of various green initiatives.

- Roll-out high ROI initiatives (e.g., electric fleet transition, route optimization AI, paperless billing).

Tools & Resources:

- Process improvement consultants

- ESG tracking tools

- Lean Six Sigma methodology

KPIs:

- Carbon footprint reduction per shipment

- Process improvement cost savings per project

- Customer perception of sustainability (via surveys)

Expected ROI: Depends on R-modeled ROI and brand enhancement. Key is to choose high ROI projects and build ESG credibility.

Dummy Data Example: Sustainability Scenario Analysis

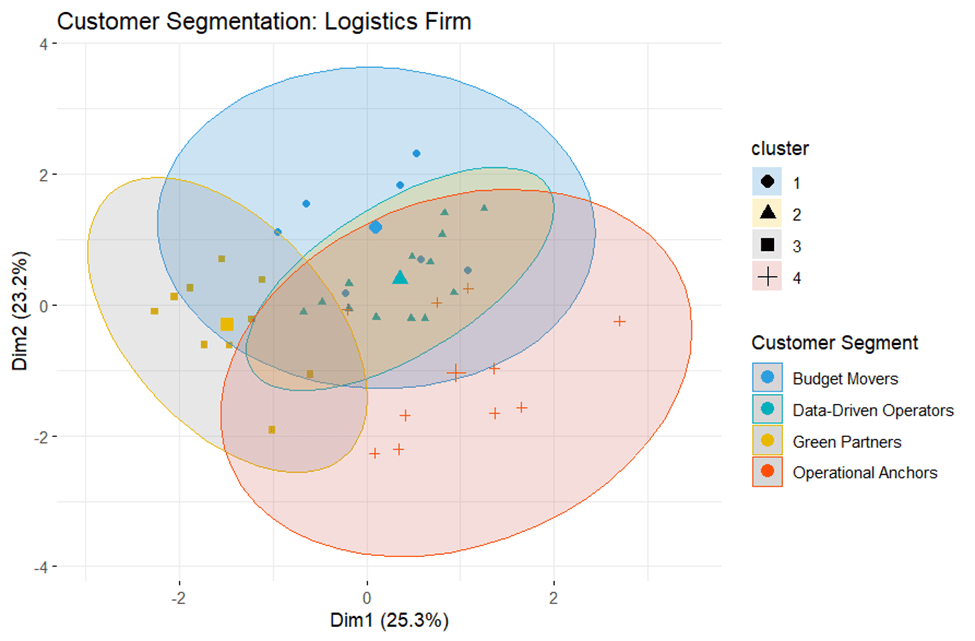

Customer Segmentation

Successful customer segmentation empowers logistic firms to tailor pricing, promotions, and value-added services to specific customer needs, especially during periods of economic uncertainty. When equipped with comprehensive understanding of distinct buyer behaviors and priorities, the firm can optimize revenue and retention while deploying resources strategically.

Segmentation Methodology

I decided to use a K-means clustering analysis and dummy data in RStudio where customers can be segmented based on key variables such as:

- Shipment volume and frequency

- Revenue contribution

- Industry type

- Sensitivity to price changes

- Adoption of digital/analytics services

- Sustainability preferences

To demonstrate a practical implementation, I have defined four actionable customer segments below.

- Cost-Sensitive Clients (“Budget Movers”)

Profile:

- Small business/startup

- Low shipment frequency

- Extremely price sensitive, high churn risk during inflationary periods

Behaviors:

- No add-ons and basic service preferences

- Strong reactions to discounts and price changes

Strategic Approach:

- Pricing Tier: Basic Tier (low-cost, essential services only)

- Promotions: Frequency incentives, time-bound discounts

- Analytics Offering: Minimal, free basic tracking dashboard offering as an incentive

Goal: Retention of these customers will be driven by competitive pricing and simplified offerings, while limiting service complexity and margin pressure.

- High-Volume Clients (“Operational Anchors”)

Profile:

- Mid-Large businesses

- High shipment frequency, recurring bulk shipments

- Value predictability, reliability, and performance metrics

Behaviors:

- Inclined to pay more for guaranteed SLAs and integrated services

- Receptible to long-term contracts and volume discounts

Strategic Approach:

- Pricing Tier: Premium Tier with performance guarantees

- Promotions: Volume-based discounts, loyalty perks

- Analytics Offering: Complete service dashboard with KPI benchmarking, predictive ETA, and exception reporting

Goal: Augment lifetime value (LTV) through analytics upselling, loyalty programs, and strategic account management.

- Sustainability-Focused Clients (“Green Partners”)

Profile:

- ESG-driven businesses, often in retail, CPG, or healthcare

- Mid-High volume, willing to pay more for carbon-neutral logistics

Behaviors:

- Require emissions transparency and ESG compliance

- Prefer vendors aligned with their sustainability goals

Strategic Approach:

- Pricing Tier: Standard or Premium Tier with ESG service upsell

- Promotions: Emission-reduction credits, recognition in annual ESG reports

- Analytics Offering: ESG dashboards (carbon footprint, emissions trend, route optimization visibility)

Goal: Propel brand as an ESG authority and retain customers through sustainability-driven value propositions and green partnerships.

- Digital-Native Clients (“Data-Driven Operators”)

Profile:

- Technologically smart companies in e-commerce, SaaS, or 3PL

- Value integration, automation, and data access

Behaviors:

- Desire real-time APIs, self-service dashboards, automated reports

- Prone to paying for insights that optimize their own operations

Strategic Approach:

- Pricing Tier: Premium Tier with customization options

- Promotions: Early entry to analytics features, API usage credits

- Analytics Offering: Full-stack analytics platform, real-time alerts, white-labeled reporting

Goal: Emphasize subscription-based analytics revenue, co-innovate with clients, and reduce churn through data stickiness.

| Segment | Tier | Promotions | Analytics Offering |

| Budget Movers | Basic | Usage-based discounts | Basic tracking dashboard |

| Operational Anchors | Premium | Volume loyalty, SLA guarantees | Full KPI dashboard, route & delivery ETAs |

| Green Partners | Std/Prem | Carbon credit perks | Emissions dashboards, ESG reports |

| Data-Driven Operators | Premium | Custom integration packages | Real-time API, predictive analytics |

SWOT Analysis

Strengths

- Existing Customer Relationships: Strong foundation with customers already requesting analytics and insights

- Operational Data Assets: Historical logistics data that can be monetized through analytics products

- Industry Expertise: Comprehensive understanding of logistics operations, route optimization, and delivery metrics

- Established Infrastructure: Existing operational systems and processes that can be leveraged for new revenue streams

- Customer Trust: Proven reliability in logistics services provides credibility for expanded offerings

- Stakeholder Alignment: Well organized structure with defined roles across management, operations, and technology teams

Weaknesses

- Single Revenue Stream Dependency: Currently over-reliant on traditional logistics services

- Economic Sensitivity: Highly vulnerable to macroeconomic fluctuations and downturns

- Pricing Strategy Limitations: One-size-fits-all approach doesn’t optimize value capture across customer segments

- Limited Diversification: Minimal alternative income sources to protect against industry volatility

- Potential Resource Constraints: May lack internal specialized skills in analytics product development and tiered pricing implementation

- Change Management Challenges: Organizational resistance to new business models and revenue strategies

Opportunities

- Data Monetization Market: Growing demand for business intelligence and analytics across industries

- Sustainability Trend: Increasing customer shifts towards environmental responsibility creates new value propositions

- Technology Partnerships: Strategic alliances can enhance capabilities and reduce costs

- Customer Segmentation: Untapped opportunities to serve different customer needs with tailored solutions

- Loyalty Program Benefits: Opportunity to increase customer lifetime value and retention

- Premium Service Offerings: Market willingness to pay for enhanced analytics and strategic insights

Threats

- Economic Downturns: Recession and inflation directly impact customer demand and pricing power

- Competitive Pressure: Imitation by other logistics firms as they may implement similar diversification strategies

- Technology Disruption: Rapid changes in logistics technology could render current advantages obsolete

- Customer Price Sensitivity: Economic pressures may lead customers to seek lower-cost alternatives

- Regulatory Changes: Environmental and industry regulations could affect operational costs

- Market Saturation: Driving competition in both traditional logistics and analytics services

3-Year Financial Impact Model

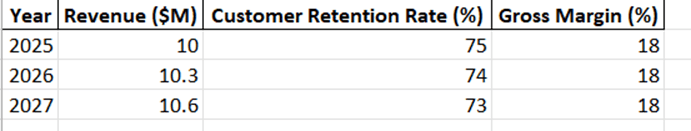

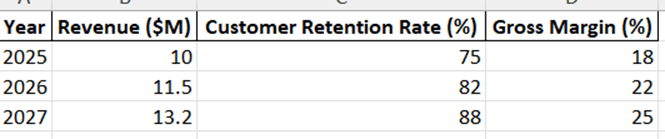

A dummy financial model was developed with the following data points that were used to create visualizations in RStudio:

Baseline Scenario

All Strategies Scenario

Taking account of the projections from the firm’s baseline and strategic scenarios, I then calculated the total gross profit over 3 years in both cases. Gross profit is achieved by multiplying annual revenue by gross margin percentage. The ROI is then computed using the following formula:

ROI = (Total Strategic Gross Profit−Total Baseline Gross Profit) −Implementation Cost *100

Implementation Cost

An estimated implementation cost of $1.5 million over three years was assumed, encompassing technology upgrades, training, promotional campaigns, and sustainability certifications.

| Metric | Baseline Scenario | Strategy Scenario |

| Total Revenue (2025–2027) | $30.00M | $36.00M |

| Average Gross Margin (%) | 26.67% | 33.33% |

| Total Gross Profit | $8.00M | $12.00M |

| Implementation Cost | – | $1.50M |

| Net Additional Profit | – | $4.00M |

| ROI | – | 166.67% |

*Table is AI generated, and Figures have been rounded.

The analysis shows a 166.67% ROI with respect to the strategic investment, indicating a strong financial justification for pursuing the outlined initiatives. Over three years, the strategies are projected to generate $4 million in additional net profit beyond the implementation cost. This gain is steered by both revenue growth (from $30M to $36M) and margin expansion (from 26.67% to 33.33%), reflecting enriched pricing discipline, customer loyalty, and operational efficiency.

The ROI surpasses common corporate investment thresholds (typically 15–30%), suggesting that the firm is well-positioned to still thrive during economic downturns and potentially outperform competitors during periods of volatility.

Strategic Implications

- Short-term: Instant benefits from pricing optimization and customer segmentation can yield improvements in cash flow and reduce churn.

- Mid-term: Partnership and analytics initiatives may generate new service lines and minimize operational costs.

- Long-term: Sustainability programs could enhance brand value and unlock premium segments focused on ESG compliance.

Investing in the proposed strategies is not only justified but highly favorable under conservative assumptions. Top logistics Executives should consider phasing in these initiatives with rigorous performance tracking to maximize returns while managing risk.

Appendix

Extensiv (2024), Transformative Logistics Strategies: Overcoming the Freight Recession , https://www.extensiv.com/blog/transformative-logistics-strategies-overcoming-the-freight-recession

Xeneta (2025), The Biggest Global Supply Chain Risks of 2025, https://www.xeneta.com/blog/the-biggest-global-supply-chain-risks-of-2025

Gurley, L.K. (2025), Employers added 139,000 jobs in May, a solid gain amid economic headwinds, https://www.washingtonpost.com/business/2025/06/06/jobs-report-may-unemployment/

Sharkey, G (2025), How automation is solving logistics’ biggest problems in 2025, https://www.freightwaves.com/news/how-automation-is-solving-logistics-biggest-problems-in-2025