Growth is a pivotal goal for any organization. As companies expand, it becomes crucial to manage various operational aspects effectively. One such critical aspect is the management of accounts receivable. Maintaining low accounts receivable days, even amidst growth, is essential for ensuring a healthy cash flow and sustaining financial stability. In this article, we’ll explore some practical strategies to achieve this goal without losing sight of the big picture.

1. Efficient Invoicing Processes

Streamlining your invoicing processes is fundamental in managing accounts receivable effectively. Implement clear and concise invoicing procedures, ensuring that invoices are sent promptly after services or products are delivered. Make sure your invoices are accurate and include all necessary details to minimize disputes or delays in payment. Utilizing automated invoicing systems can also expedite the process and reduce the chances of human errors.

2. Clear Payment Terms and Policies

Transparency is key when it comes to payment terms and policies. Clearly outline your payment expectations in contracts and invoices. Specify the due dates, any applicable late fees, and the preferred payment methods. By setting clear expectations from the start, you reduce the likelihood of misunderstandings and disputes down the line.

3. Offer Incentives for Early Payment

Encouraging clients to settle their invoices early can significantly impact your accounts receivable days. Consider offering incentives such as discounts for clients who pay before the due date. This creates a win-win situation: clients save money, and you receive payments faster, helping to keep your cash flow steady.

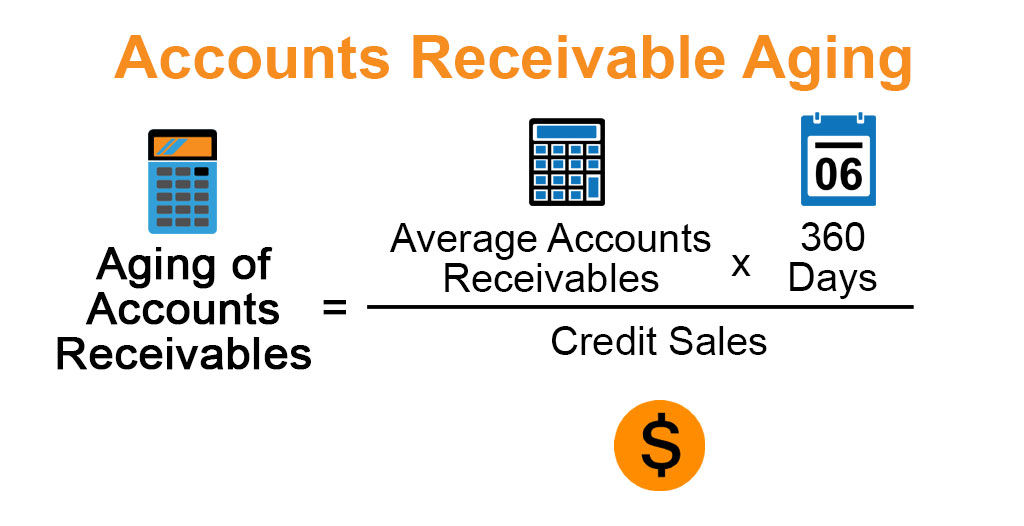

4. Regularly Monitor Aging Reports

As your business grows, monitoring your accounts receivable becomes even more critical. Regularly review aging reports to identify overdue invoices and take prompt action. Implement a system for following up with clients whose payments are past due. This could involve sending reminders, making phone calls, or even offering payment plans if necessary.

5. Implement a Credit Policy

Having a well-defined credit policy is essential to minimize the risk of late payments or bad debts. Conduct thorough credit checks on new clients before extending credit to them. Set credit limits based on their financial stability and track their payment history. Additionally, be prepared to review and adjust credit limits as the client relationship evolves.

6. Foster Strong Communication

Open and transparent communication is key to avoiding payment delays. Establish a relationship of trust with your clients, where they feel comfortable discussing any potential issues that might affect their ability to pay on time. This proactive approach allows you to address problems early, find solutions together, and maintain a positive business relationship.

7. Offer Multiple Payment Options

Diversifying payment options can expedite the payment process. While traditional methods like checks and bank transfers are common, consider incorporating digital payment methods, credit card payments, and online platforms. The convenience of various payment options can encourage clients to settle their invoices promptly.

8. Leverage Technology

As your business scales, technology can be your greatest ally in managing accounts receivable. Invest in accounting software that offers features like automated reminders, recurring invoices, and easy tracking of payment statuses. These tools not only save time but also enhance accuracy and efficiency in managing your finances.

9. Cross-functional Collaboration

The growth of a business often leads to increased complexity in operations. Collaborate closely with your sales, customer service, and finance teams to ensure a seamless flow of information. When everyone is aligned on customer interactions and payment expectations, it becomes easier to address potential issues before they escalate.

10. Regularly Evaluate Processes

Growth should never mean complacency. Continuously evaluate your accounts receivable processes to identify areas for improvement. Regularly assess your invoicing procedures, credit policies, and communication strategies to ensure they remain effective as your business expands.

In Conclusion

As businesses experience growth, maintaining low accounts receivable days becomes a critical component of financial success. Efficient invoicing, clear payment terms, incentives for early payment, and proactive communication are just a few strategies to keep cash flowing smoothly. By embracing technology, fostering collaboration, and regularly reviewing your processes, you can strike a balance between growth and financial stability, ensuring that your business thrives well into the future.

Like this post? Buy my book, Workflows: How to Design, Improve and Automate High Performance Processes to start your process improvement journey.